Ghana Income Tax Rate 2025. Overview of ghana salary calculator. This tool is designed for simplicity and ease of use, focusing solely on income.

The ghana revenue authority (gra) have confirmed that they have not started to implement the new tax rates for 2025, and that the effective date will be. Calculate your income tax, social security and.

With a housing deficit estimated to be 1.8m units, ghana is looking to boost the number of residential premises by providing tax incentives to local and foreign.

Facebook, Year 2025 chargeable income gh¢ rate % tax payable gh¢ cumulative income gh¢ cumulative tax gh¢ first: This tool is designed for simplicity and ease of use, focusing solely on income.

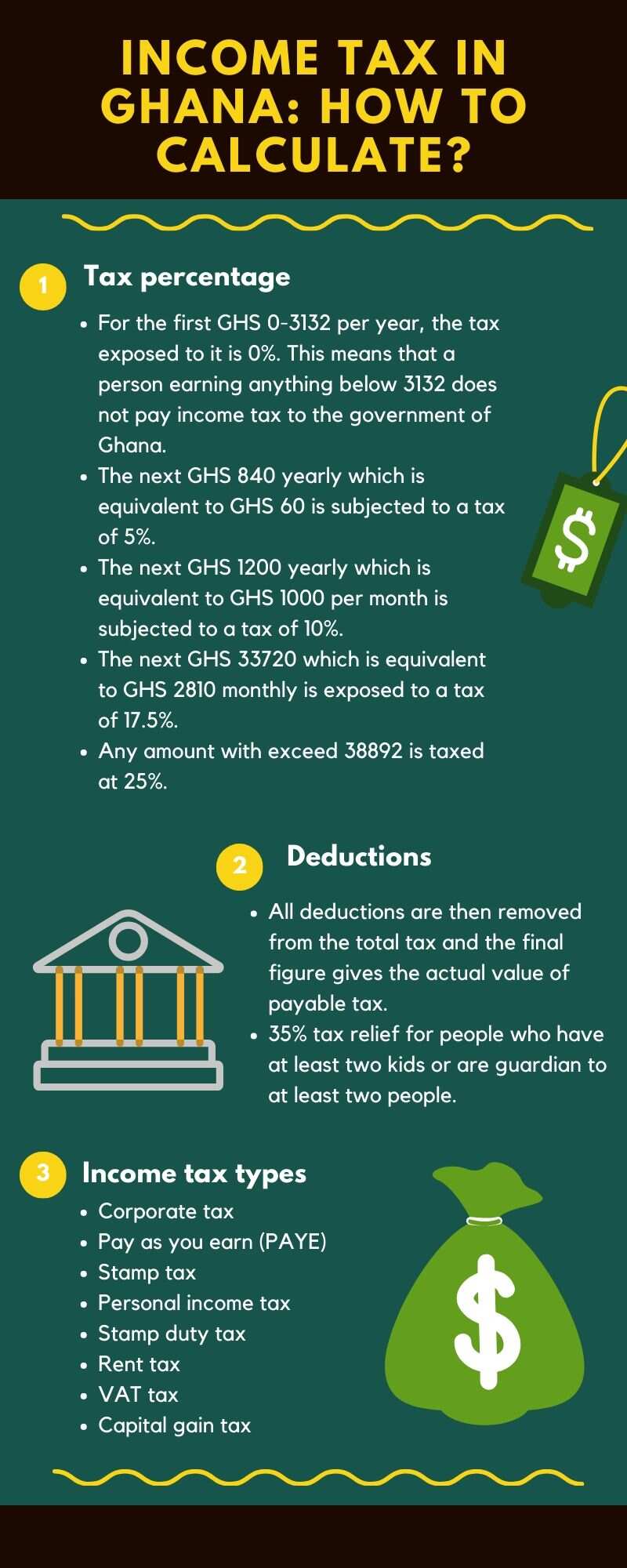

tax in Ghana 2025 how to calculate?, The ghana tax calculators are updated with the rates and thresholds up to and. Calculate your income tax, social security and.

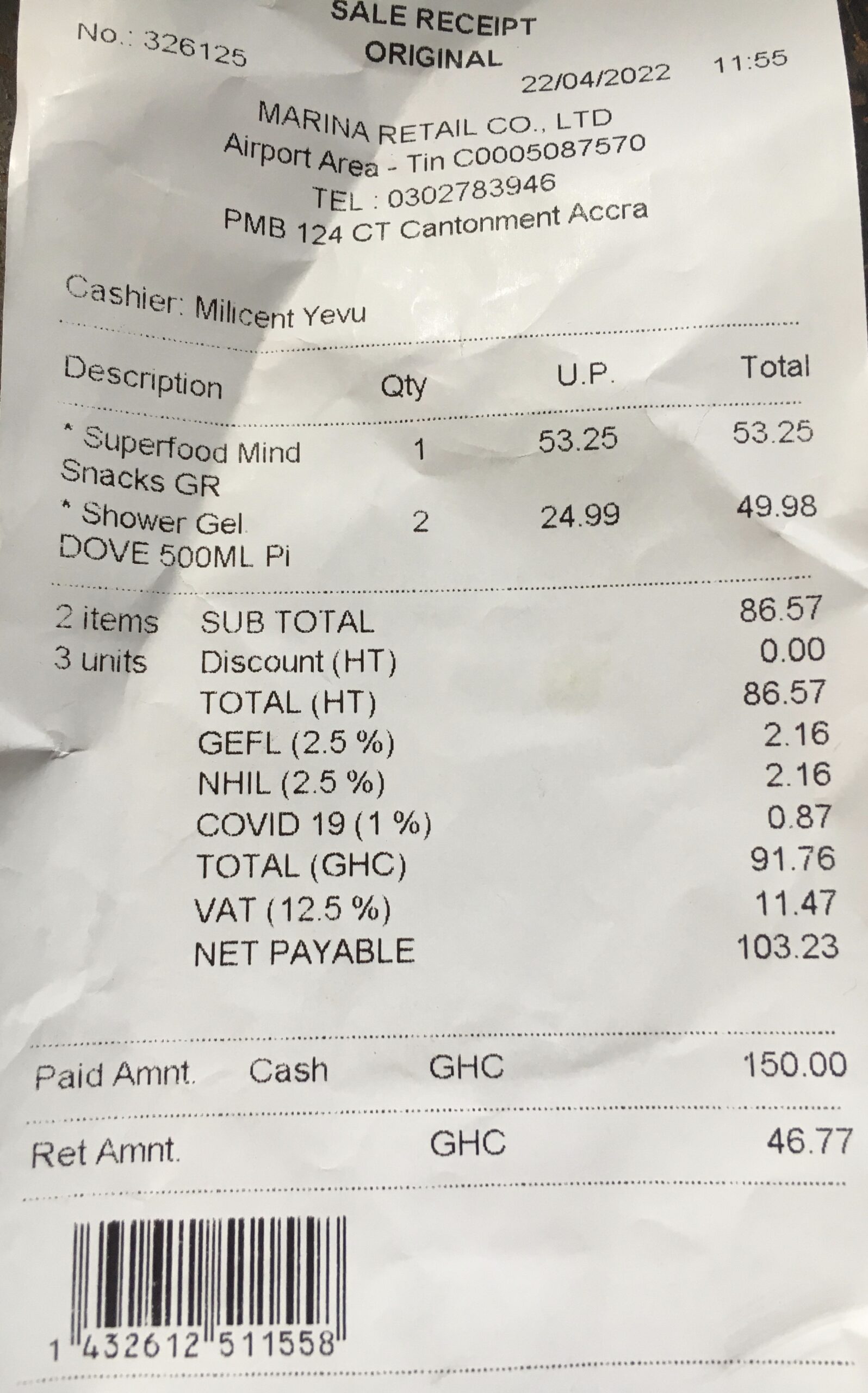

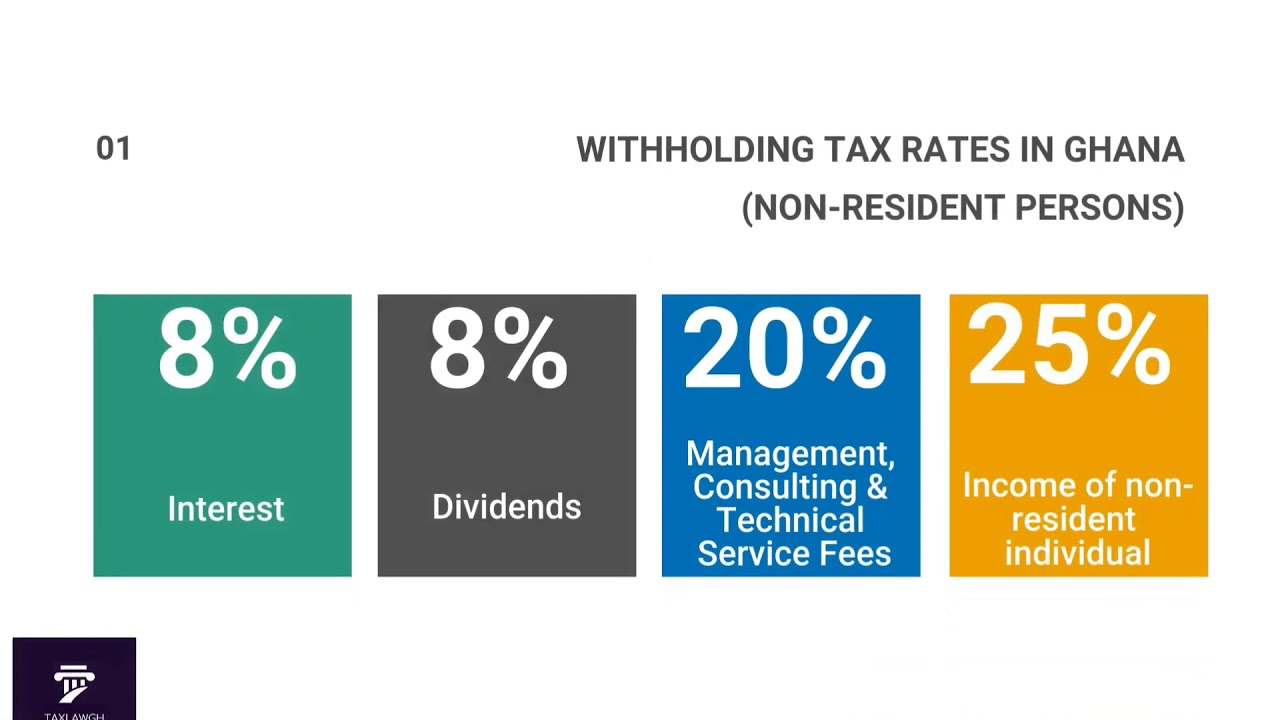

Withholding tax in Ghana 2025 current rates and everything you need to, That means that your net pay will be gh₵ 147,619 per year, or gh₵ 12,302 per month. Personal income tax (pit) it is a tax charged on an individual’s total income (income from employment, business and investment).

Payroll in Ghana Payroll Process and Payroll Taxes in Ghana Run, That means that your net pay will be gh₵ 147,619 per year, or gh₵ 12,302 per month. Rate of tax (%) old chargeable income (ghs*) new chargeable income (ghs*) difference (ghs*) 1.

Ghanaians paying VAT on other taxes, but are unaware Ghana Business News, Ghana residents income tax tables in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold; Effortlessly calculate your income taxes and relevant.

![[UPDATE] 2025 New Tax Rates (PCB)](https://s3.amazonaws.com/cdn.freshdesk.com/data/helpdesk/attachments/production/2043451104621/original/c85QKb7915JzLCvxtOiWsQ6MigpS-kHHWQ.png?1686726245)

[UPDATE] 2025 New Tax Rates (PCB), With a housing deficit estimated to be 1.8m units, ghana is looking to boost the number of residential premises by providing tax incentives to local and foreign. Year 2025 chargeable income gh¢ rate % tax payable gh¢ cumulative income gh¢ cumulative tax gh¢ first:

How to compute the new (2025) Employee Tax (PAYE) in Ghana, Year 2025 chargeable income gh¢ rate % tax payable gh¢ cumulative income gh¢ cumulative tax gh¢ first: This tool is designed for simplicity and ease of use, focusing solely on income.

How to compute the new Employee Tax (PAYE) in Ghana [template, View tax rates in table format: Ghana has a progressive income tax system with rates from 0% to 25%.

Ghana Tax Rates 2025 YouTube, Year 2025 chargeable income gh¢ rate % tax payable gh¢ cumulative income gh¢ cumulative tax gh¢ first: The ghana revenue authority (gra) announces for the information of the general public the coming into force of amendments to the following.

Ghana Withholding Tax Rates 2025 YouTube, Corporate tax rates, indirect tax rates, individual income tax rates, employer social security rates, and employee social security rates. The calculator is updated with the latest tax rates and brackets as per the 2025 tax year in ghana.