Sales Tax At Restaurants. Understanding the application of sales tax to the restaurant industry. Preparing for the inevitable restaurant state sales tax audit.

This requirement encompasses not just food and beverage sales but also. Sales tax compliance for restaurants can be a daunting task;

Texas Sales Tax Basics for Restaurants and Bars Sales Tax Helper, Managing proper tax collection, adhering to filing deadlines, selecting and. Restaurant sales tax by state and city.

Everything You Need to Know about Restaurant Taxes, Here are the 2025 rates broken down by area: Sales tax reduced to 5% for islamabad restaurants.

New Jersey Sales Tax on Restaurants Sales Tax Helper, Like most states, texas heavily targets bars and restaurants for sales tax audits. Here are the 2025 rates broken down by area:

Your Guide to Restaurant Sales Tax (and How to Make It Less Painful), Read ahead for sales tax examples for restaurants from four different states. We’ll look at general sales tax, meal tax, liquor tax, and other taxes that states levy on restaurants.

Ohio Sales Tax for Restaurants Sales Tax Helper, For example, if a bar has projected sales of $40,000 but only reported $25,000, it will be asked to pay tax on the discrepancy. Here is a guideline of what the dor considers.

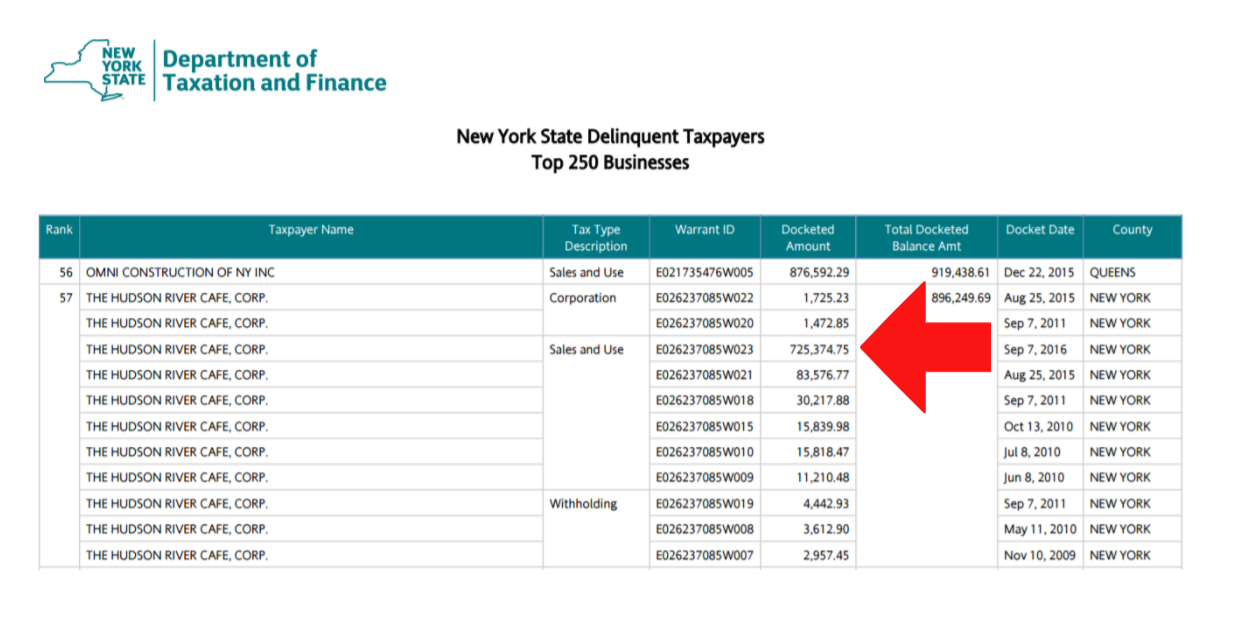

New York Restaurant Sales Tax Audit Analysis, We’ll look at general sales tax, meal tax, liquor tax, and other taxes that states levy on restaurants. Customers can enjoy $10.40 off any purchase of $30 or more at grimaldi's locations across the country on monday,.

Business Law Video Sales Tax Basics for Restaurants, In illinois, “sales tax” refers to several tax acts. Restaurants are generally required to collect sales tax from their customers on the purchase of food and beverages.

Colorado Retailer Retention of Sales Tax & Your Restaurant YouTube, By sales tax helper llc. Sales tax liability refers to the legal obligation of a business to collect, report, and remit.

California Sales Tax Basics for Restaurants & Bars, Sales taxation in restaurants varies by jurisdiction and can have. Total sales and use tax in new york city = 8.875%;

RESTAURANTS FLORIDA SALES AND USE TAX HANDBOOK, For restaurants that sell what’s considered “general merchandise”,. Understanding sales tax liability for restaurants, bars, and food trucks: